Iron Ore: Canada to Be a Top 5 Producer by 2020

Iron Ore Stocks… Is the bottom in?

Iron ore has been a major growth theme over the past 5 years with global production doubling in the first decade of the millennium. China has been a main driver behind demand for iron ore with global steel production increasing from 55Mt per year to 600Mt per year from 2001 to 2010. China accounts for nearly ~45% of global steel production. Iron ore is a commodity that will continue to see strength as steel is the main building block needed to build skyscrapers, bridges, roads and the necessary infrastructure that ties it all together. Over the next 5 years, another 300Mt of capacity will be added to steel blast furnaces around the globe, with most of this capacity coming from China.

While last year’s sell off has been extra hard for some materials companies with many gold stocks trading close to 2009 lows, iron ore companies remain resilient trading well above 2009 lows. Adrianna Resources ADI-V $1.06 is 5 times the $0.20 share price it was trading at in March of 2009. Labrador Iron Mines LIM.TO $5.00has lost nearly a 1/3 of its value since April of 2011, and is still trading 5 times 2009 lows of $1. Iron ore prices remain elevated approaching $150/t after correcting briefly in October to around $120/t which is still two to three times 2009 lows of $50/t. This is all due to very tight supply constraints for iron ore which is forecasted to be in a production deficit well into 2015.

One thing for certain is that iron ore stocks have been in a correction for 12 months along with most other materials stocks. They look like a very attractive group to buy on a relative value basis as the industry’s growth prospects and continuing supply deficits for at least the next three years make investing conditions favorable. Iron ore is the foundation building material for 5B people around the world trying to live a “developed world lifestyle” where governments see a solution to poverty problems by urbanizing their populations en masse. With these types of conditions driving growth over the first half of the century, iron ore is the one commodity other than graphite whose growth prospects far outweigh the current mines in production.

Iron Ore Seen Rallying as China Lending Policy May Boost Demand - Businessweek

Global Iron Ore Demand is expected to double in 15 years

Iron is the world’s most commonly used metal and is the 4th most abundant element on the Earth. So why are we having supply constraints of an element that is one of the most abundant on the planet?

Simply put…China’s insatiable appetite for iron ore

China consumes most of the world’s iron ore resources for steel production while having limited supply of this raw material for the amount of steel they produce. This means they are constantly importing iron ore from abroad, and unfortunately for China, the choice of suppliers is limited with the majority of the world’s production coming from only a few countries and a few major iron ore producers. Another factor that puts even more pressure on this market is other developing nations are also increasing steel production for their own needs. This takes any additional supply off the market from other developing nations like Brazil and India.

74% of the world’s iron ore production comes from 4 countries; Australia, Brazil, India and China. 3 major producers control the majority of iron ore coming out of those countries; Rio Tinto, Vale and BHP Billiton. China accounts for almost half of the world’s steel production and is a large net importer of iron ore which creates a huge imbalance in this market. To feed China’s massive steel industry, they consume two thirds of global iron exports.

At the height of the global recession in 2009, iron ore demand dropped 21% outside of China. Inside China? Demand for the raw material grew by 13.5%. A large portion of this was due to restocking and taking advantage of low prices in 2009, but even in the face of rising prices in 2010, 2011, and now in 2012; demand has remained constant from the Asian economic powerhouse. In March of 2011 China slowed down on its push to buy iron ore as prices approached $200 indicating buyer exhaustion nearing $200. Prices subsequently dropped marginally the first 8 months of 2011, but remained above $150 even as China cut back on purchases. Iron ore prices only dropped dramatically when fears of a 2009 repeat gripped the market in late September of 2011. Demand will generally continue to outstrip supply on a macro scenario until at least 2015 when a lot of the planned projects come online to meet increasing steel production by China and the rest of the developing world.

At the height of the global recession in 2009, iron ore demand dropped 21% outside of China. Inside China? Demand for the raw material grew by 13.5%. A large portion of this was due to restocking and taking advantage of low prices in 2009, but even in the face of rising prices in 2010, 2011, and now in 2012; demand has remained constant from the Asian economic powerhouse. In March of 2011 China slowed down on its push to buy iron ore as prices approached $200 indicating buyer exhaustion nearing $200. Prices subsequently dropped marginally the first 8 months of 2011, but remained above $150 even as China cut back on purchases. Iron ore prices only dropped dramatically when fears of a 2009 repeat gripped the market in late September of 2011. Demand will generally continue to outstrip supply on a macro scenario until at least 2015 when a lot of the planned projects come online to meet increasing steel production by China and the rest of the developing world.

BIG 3 and China

Vale, Rio Tinto and BHP Billiton make up the Big 3, a mini-cartel like CANPOTEX in Saskatchewan. They control most of the existing supply and are responsible for most of the new supply on the market. Iron ore projects require extensive capital to develop which severely limits any new entrants to the industry. Vale, Rio Tinto and BHP Billiton have no incentive to raise production until prices get so high that steel makers try and find their own sources of the commodity or the project economics become so lucrative that the barriers to entry disappear due an extremely favorable investment environment. We are at that point in the industry where supply/demand/price dynamics are making both these conditions come together at once.

Both Chinese and Indian steel makers are breaking normal supply chain avenues looking for new supply and the unexploited monster iron ore projects in the Labrador Trough have become extremely lucrative despite the remoteness of the locations in Northern Quebec due to high iron ore prices. Any price over $100/tonne makes these monster iron ore projects in the Labrador Trough some of the most lucrative development projects in mining. Until someone does something about the supply issue and brings on supply outside of the BIG 3, the BIG 3 will only increase production just enough to keep prices elevated.

It’s funny, usually you hear about China controlling supply of commodities and restricting exports like rare earths and graphite. In this situation, the roles are reversed and the Chinese are the ones paying over-inflated prices for a commodity that is vital for one of their main industries. Chinese government funded projects through 2015 include 36,000km of highways, $901B of roads, bridges and ports, $101B on railway construction, $43B on subways and 36 million economical housing units. In 3 years the Chinese plan to build the equivalent of 1 home for every person there is in Canada, a massive undertaking to say the least which will require a lot of commodities. China sees its way out of several social problems by urbanizing its population. It is one of the greatest undertakings that any nation has ever done, urbanizing 1 billion people within 30 to 50 year timeline.

This supply issue is also hampering other developing economies like India who have already restricted supply of their own iron ore exports. The real issue here is the price of development. At current iron ore prices, it is too expensive to bring their populations en masse into even a semi-urbanized society.

Chinese Are Investing Billions in the Labrador Trough

Chinese steel makers have had enough of the consortium, the price fixing, and lack of supply. They are trying to develop their own supply chain of this vital commodity for urbanization. They have had enough of being held for ransom and have brought a new dynamic to the industry. They are going outside the normal supply chain of the BIG 3 and are creating their own. They have created unprecedented opportunities in an industry with huge barriers to entry by removing the one advantage the BIG 3 had, the multi-billion dollar investments that many of these projects require. This made it impossible for anyone outside a major miner to develop these projects.

This situation has created a great investing environment for promising iron ore projects. Steel makers are looking straight at areas like the Labrador Trough to source iron ore production from. Chinese (WISCO) and Indian (Tata Steel)are going straight to the source and partnering with Canadian junior resource companies like Adrianna Resources ADI.V (50Mtpa/$12.9B cap-ex) and New Millennium NML.TO (22Mpta $4.4B cap-ex) to develop mega iron ore projects in the Labrador Trough and secure a stable supply of iron ore for the next 50 years.

Partnerships like the ones being developed over the last few years between Asian steel makers and Canadian resource companies will continue as steel companies see no other alternative but to secure new supply by spending billions developing their own source of iron ore. With projects that show good profitability at a long term prices of $90 - $120, there is no reason for Chinese steel makers to pay much more than $100/tonne over the long run term.

Vale, Rio Tinto and BHP Billiton make up the Big 3, a mini-cartel like CANPOTEX in Saskatchewan. They control most of the existing supply and are responsible for most of the new supply on the market. Iron ore projects require extensive capital to develop which severely limits any new entrants to the industry. Vale, Rio Tinto and BHP Billiton have no incentive to raise production until prices get so high that steel makers try and find their own sources of the commodity or the project economics become so lucrative that the barriers to entry disappear due an extremely favorable investment environment. We are at that point in the industry where supply/demand/price dynamics are making both these conditions come together at once.

Both Chinese and Indian steel makers are breaking normal supply chain avenues looking for new supply and the unexploited monster iron ore projects in the Labrador Trough have become extremely lucrative despite the remoteness of the locations in Northern Quebec due to high iron ore prices. Any price over $100/tonne makes these monster iron ore projects in the Labrador Trough some of the most lucrative development projects in mining. Until someone does something about the supply issue and brings on supply outside of the BIG 3, the BIG 3 will only increase production just enough to keep prices elevated.

It’s funny, usually you hear about China controlling supply of commodities and restricting exports like rare earths and graphite. In this situation, the roles are reversed and the Chinese are the ones paying over-inflated prices for a commodity that is vital for one of their main industries. Chinese government funded projects through 2015 include 36,000km of highways, $901B of roads, bridges and ports, $101B on railway construction, $43B on subways and 36 million economical housing units. In 3 years the Chinese plan to build the equivalent of 1 home for every person there is in Canada, a massive undertaking to say the least which will require a lot of commodities. China sees its way out of several social problems by urbanizing its population. It is one of the greatest undertakings that any nation has ever done, urbanizing 1 billion people within 30 to 50 year timeline.

This supply issue is also hampering other developing economies like India who have already restricted supply of their own iron ore exports. The real issue here is the price of development. At current iron ore prices, it is too expensive to bring their populations en masse into even a semi-urbanized society.

Chinese Are Investing Billions in the Labrador Trough

Chinese steel makers have had enough of the consortium, the price fixing, and lack of supply. They are trying to develop their own supply chain of this vital commodity for urbanization. They have had enough of being held for ransom and have brought a new dynamic to the industry. They are going outside the normal supply chain of the BIG 3 and are creating their own. They have created unprecedented opportunities in an industry with huge barriers to entry by removing the one advantage the BIG 3 had, the multi-billion dollar investments that many of these projects require. This made it impossible for anyone outside a major miner to develop these projects.

This situation has created a great investing environment for promising iron ore projects. Steel makers are looking straight at areas like the Labrador Trough to source iron ore production from. Chinese (WISCO) and Indian (Tata Steel)are going straight to the source and partnering with Canadian junior resource companies like Adrianna Resources ADI.V (50Mtpa/$12.9B cap-ex) and New Millennium NML.TO (22Mpta $4.4B cap-ex) to develop mega iron ore projects in the Labrador Trough and secure a stable supply of iron ore for the next 50 years.

Partnerships like the ones being developed over the last few years between Asian steel makers and Canadian resource companies will continue as steel companies see no other alternative but to secure new supply by spending billions developing their own source of iron ore. With projects that show good profitability at a long term prices of $90 - $120, there is no reason for Chinese steel makers to pay much more than $100/tonne over the long run term.

The Labrador Trough Positions Canada to be a TOP 5 Global Iron Ore Producer.

In 2009 global production of iron ore was 1.6Bt. China 234Mt, Australia 394Mt, Brazil 300Mt, and India 245Mt making up 74% of global supply. Canada produced a mere 32Mt in 2009. Production has almost doubled around Labrador City in Southern area of the Labrador Trough highlighting the areas ability to ramp up production at a cost effective price.

Labrador City (Southern Labrador Trough)

This is current where all the current production is focused because it has the most available infrastructure. Consolidated Thompson’s Bloom Lake Mine came online and was promptly bought out by Cliffs Natural Resources. Alderon Resources ADV-VKami Project is set for production in late 2014 near Labrador City and Champion Minerals CHM-TO Fire Lake is another high value producer in the Trough.

- Cliffs 18 – 22Mt con/year

- Rio Tinto 17Mt con/year

- ArcelorMittal 13 - 19Mt con/year

Schefferville (Central Labrador Trough)

Labrador Iron MinesLIM-TO started production at the James Mine in June of 2011 near Schefferville. Schefferville is north of Labrador City and requires a bit more infrastructure spending is further from the Port at Sept Iles. It is where the monster projects lie and where most of the Labrador Tough’s untouched capacity is. New Millennium, Cap-Ex Ventures and Century Iron Mines all are developing very large deposits in the area. At $5 a share, LIM is an extremely attractive investment opportunity being the first producer in the area of Schefferville giving them first mover status. LIM topped out at over $14 in April of 2011. The share price of LIM is typical of any mining company entering into production. The company has suffered a steep sell-off after the dramatic rise in the second half of 2010. It certainly doesn’t help that LIM was looking for a large sum of money at the same time they were consolidating forcing them to raise more than $71M at $5 per share. LIM has tremendous leverage for a junior mining company entering into production in an industry where valuations for projects a rarely less than $2B NPV.

Ungaava Bay (North Labrador Trough)

The government of Canada has committed port expansion near Sept Iles of 50Mt to 60Mt with up to 100Mt eventual expansion. That is not nearly enough for port capacity for all of the planned projects in the Labrador Trough. It is enough capacity for the projects near Schefferville and south of that location, but not for more northern projects like Lac Otelnuk. What it does is open up the potential for the government to examine other logical port locations including construction of a large deep water port in Ungaava Bay with 50Mt to 100Mt capacity to support the massive projects in the north part of the Labrador Trough. According to FEO’s PEA, shipping from Ungaava Bay is $6/t to $7/t which dramatically reduces shipping costs by rail. Costs and project economics for Adrianna’s Lac Otelnuk may be dramatically reduced shipping their product north to Ungaava Bay than south to Sept Iles.

The Labrador Trough is the last major iron ore belt in the world that has untouched iron ore capacity. It is an area in the world that could easily see in excess of 200Mt of production per year over the next decade vaulting Canada onto the global stage as a major iron ore producing country. Canada has huge capacity to increase global production if the infrastructure is in place. With only 32Mt produced in 2009 and an estimated 50Mt to 60Mt per year in 2012, Canada is an iron ore resource rich country that has shown it is capable of increasing iron ore production from the massive iron ore deposits in the Labrador Trough. These deposits have been unexploited since their discovery in the 40’s and 50’s that will give Canada greater than 200Mt production capacity when the infrastructure is laid.

The remoteness of the Labrador Trough was one of the main reasons why these massive deposits have remained unexploited for years. More iron ore is needed for increasing global steel production and countries like Brazil and Australia are nearing capacity and have no incentive to increase capacity. There is no other concentrated area in the world that has the potential of the Labrador Trough. 5 projects in the Labrador Trough once in production over the next 10 years will produce 100Mt – 120Mt per year between the 5 of them.

Deposits slated for production by 2016...

- Adrianna Resources ADI-V $1.06/WISCO- Lac Otelnuk 50Mt

- Oceanic Iron Ore Corp FEO-V $0.40- Hopes Advance 20Mt

- New Millennium NML-TO $2.44/Tata Steel- Lab Mag 22Mt

- Alderon Resources $3.09- Kami 8 -16Mt

- Champion Minerals CHM-TO $1.68- Fire Lake ~9Mt

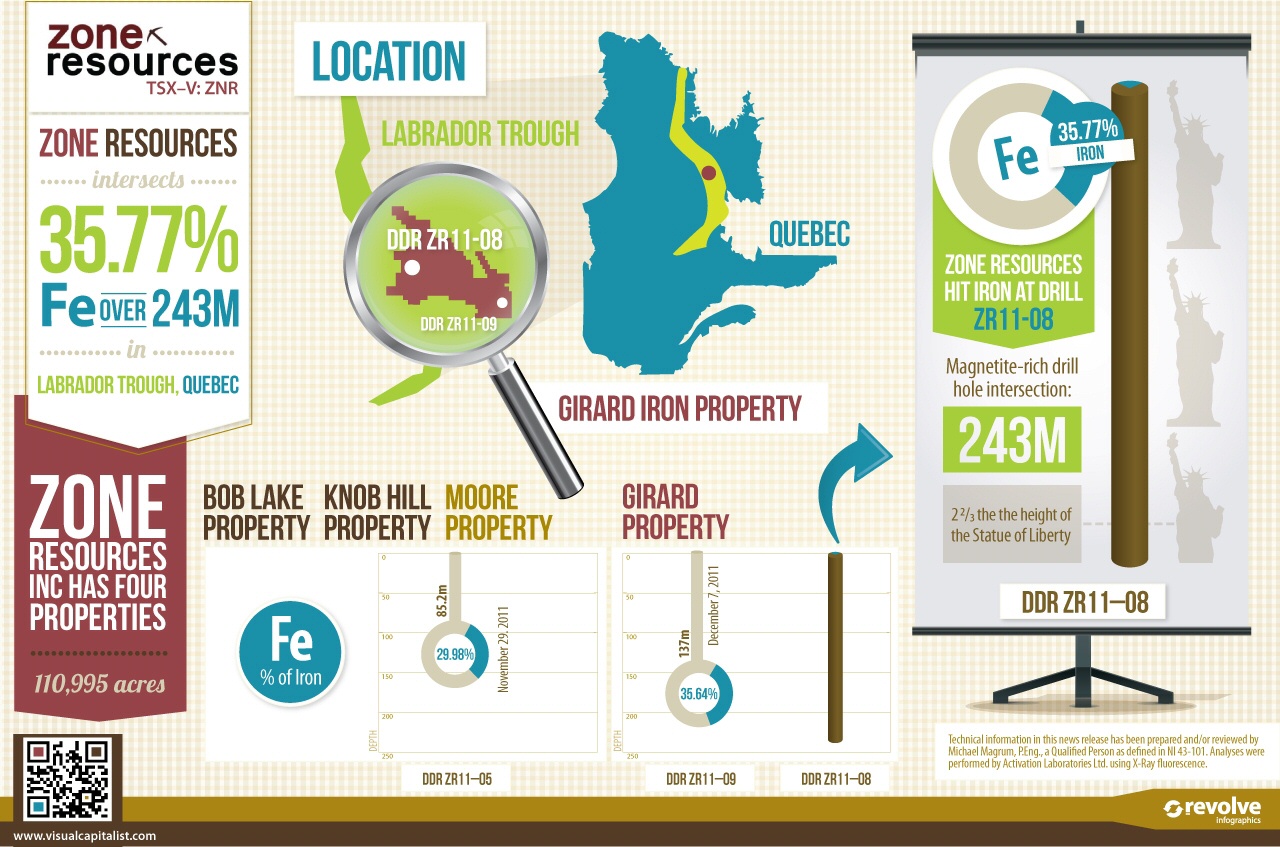

In addition to these potential producers, there have been several significant discoveries in the Labrador Trough. Century Iron Mines FER-V $1.97 Attikamagen looks to be a large high value iron ore project,Cap-Ex Ventures CEV-V $0.98 has made a big discovery on Block 103, and Zone Resources ZNR-V $0.10 is on to a material discovery on Girard.

Follow the money… in this case its Chinese and Indian steel maker money!!!

Iron ore projects are the most capital intensive projects in the mining industry. They depend on billions of dollars of infrastructure which is a major barrier to entry in the industry. Exploration is not as big of a risk as financing is for an iron ore project. The big money is going into development of projects in Canada’s Labrador Trough with Chinese and Indian steel companies committing the billions in capex needed so these projects can be built. China does not want to be hamstrung for iron ore for the next 15 -25 years while it continues to develop and urbanize the countryside. Steel companies see Canada as a big opportunity to secure future long term supply at reasonable prices which are currently much less than the spot price.

India is restricting exports of iron ore. Australia is China’s only major reliable source for iron ore and Australia’s short term supply is limited by port capacity. Their reserves are also being depleted at a more rapid rate than anticipated and are not being replenished. Australia’s current reserves are estimated to last no more than 60 years and was the discovery back in the 60’s and 70’s that brought Canada’s iron ore production to a screeching halt. With that in mind, there are limited options for the Chinese to increase supply. The logical choice of course is Canada’s largely untapped and underexplored iron rich lands of the Labrador Trough where if the Chinese put up the money… the supply is all theirs.

So to answer the original question, is the bottom for iron ore stocks in? It is a sector that is showing signs of strength, especially in the price of the commodity. It is in an industry where pressures are clearly not abating anytime soon. When looking at share price performance, some companies like NML and CEV have rebounded close to 2011 highs while other companies trade near year lows. The sector is showing some signs of life, but there seems to still be good value to be had with names like Labrador Iron Mines LIM-TO and 2012’s big discovery on Girard Zone Resources ZNR-V trading close to year lows.

Keys to success in investing in future iron mines.

- Product – There are several different products that an iron ore operation can produce

- Direct Shipping Ore (DSO) High grading Hematite requires little beneficiation and can be shipped directly to the steel plants in China. There are huge premiums on companies who have defined 10 – 20 years production of DSO (50Mt -100Mt). The major advantage is dramatically reduced capital costs and ability to fast track production in comparison to the $3B to $10B taconite projects in the Labrador Trough. E.G. Labrador Iron Mines LIM-T DSO projects around Schefferville.

- Iron Ore Pellets – This is one of the most ‘finished’ products that an iron ore operation can produce. Premium pricing in the industry, but requires the most amount of capital of any type of iron ore mining operation. E.G. Adrianna’s ADI-V Lac Otelnuk.

- Iron Ore Concentrate - This is an unfinished product that would be shipped to a refiner. The major benefit is reduced capital costs when compared to producing pellets. Most projects tend to ship concentrate. E.G. Oceanic Iron Ore FEO-V Hopes Advance Project.

- Financial Partner - Asian steel companies are investing in at least 25 - 50 years of supply of iron ore -securing deals with the right partners will ensure financial viability low dilution and long term success.

- Grade – if it’s not DSO then the highest grade magnetite deposits are the next best thing. Greater than >30% vs. less than <30% are factors that need to be considered. A deposit grading 25% vs. a deposit grading 35% is a material difference.

- Location – in mining location is everything. Climate, infrastructure, close to shipping lanes all become very important when considering you are shipping 10 – 50 million tonnes of ore a year. Near an existing mine and infrastructure whare rail and power is readily available or near deep sea access are preferable locations for new iron ore mines. Rail lines can be an expensive capex cost and adds to shipping costs. Landlocked remote locations can make a project prohibitive. Some alternatives to consider instead of rail would be a slurry pipeline.

- Scale – BIGGER is BETTER!!! A company that has reserves and resources for 100 years at 50Mtpa and can take advantage of scale will be worth more 10 years from now because of ability to ramp up production.

- MGMT– Building relationships and making billion dollar financial deals is vital for success and minimizing pre-production dilution.

| Company | Project | Owner-ship | M & I | Fe % | Inferred | Fe % | Market Cap (FD) | Pre-tax NPV | Production |

| Adriana Resources ADI-V | Lac Otelnuk50Mtpa | 40% | 4.89Bt | 29.0% | 1.56Bt | 29.6% | $177M (165M shares) | $15.2B NPV 20% IRR 8% Risk | 50Mtpa @ $100/t $12.9B capex |

| New Millennium Iron NML-T | Lab Mag Ke Mag 22Mtpa | 80% 80% | 4.6Bt 2.45Bt | 29.5% 31.2% | 1.15Bt 1.01Bt | 29.3% 31.2% | $464M (190M shares) | $8.5B NPV 25.2% IRR 8% Risk | 22Mtpa @ $90/t $4.4B capex |

| Oceanic Iron Ore FEO-V | Ungaava Bay 20Mtpa | 100% | 462Mt | 32.0% | 1.03Bt | 32.3% | $86M (216M shares) | $10.4B NPV 34% IRR 8% Risk | 20Mtpa @ $115/t $3.7B Capex |

| Alderon Iron Ore Corp ADV-T | Kami 8 - 16Mtpa | 100% | 490Mt | 30.0% | 598Mt | 30.3% | $357M (116M shares) | $3.1B NPV 40% IRR 8% Risk | 8Mtpa @ $125/t $1B Capex |

| Champion Minerals CHM-T | Fire Lake | 82.5% | 400.1Mt | 30.6% | 661.2Mt | 27.7% | $180M (108M shares) | $4.0B NPV 41.5% IRR 8% Risk | 8.7Mtpa @ $115/t $1.37B Capex |

| Century Iron Mines FER-V | Duncan Lake Sunny Lake Attikamagen | 65% 60% 60% | 30Mt - - | 23.8% - - | 821Mt - - | 24.5% - - | $180M | N/A | N/A |

| Cap-Ex Ventures CEV-V | Block 103 | 100% | - | ~30% | - | ~30% | $117M (120M shares) | N/A | N/A |

| Zone Resources ZNR-V | Girard Lake Moor-Ross | 100% | - | ~35% | - | ~35% | $10.5M (116M shares) | N/A | N/A |

Christopher Skidmore

Beat the Market Stock Picks